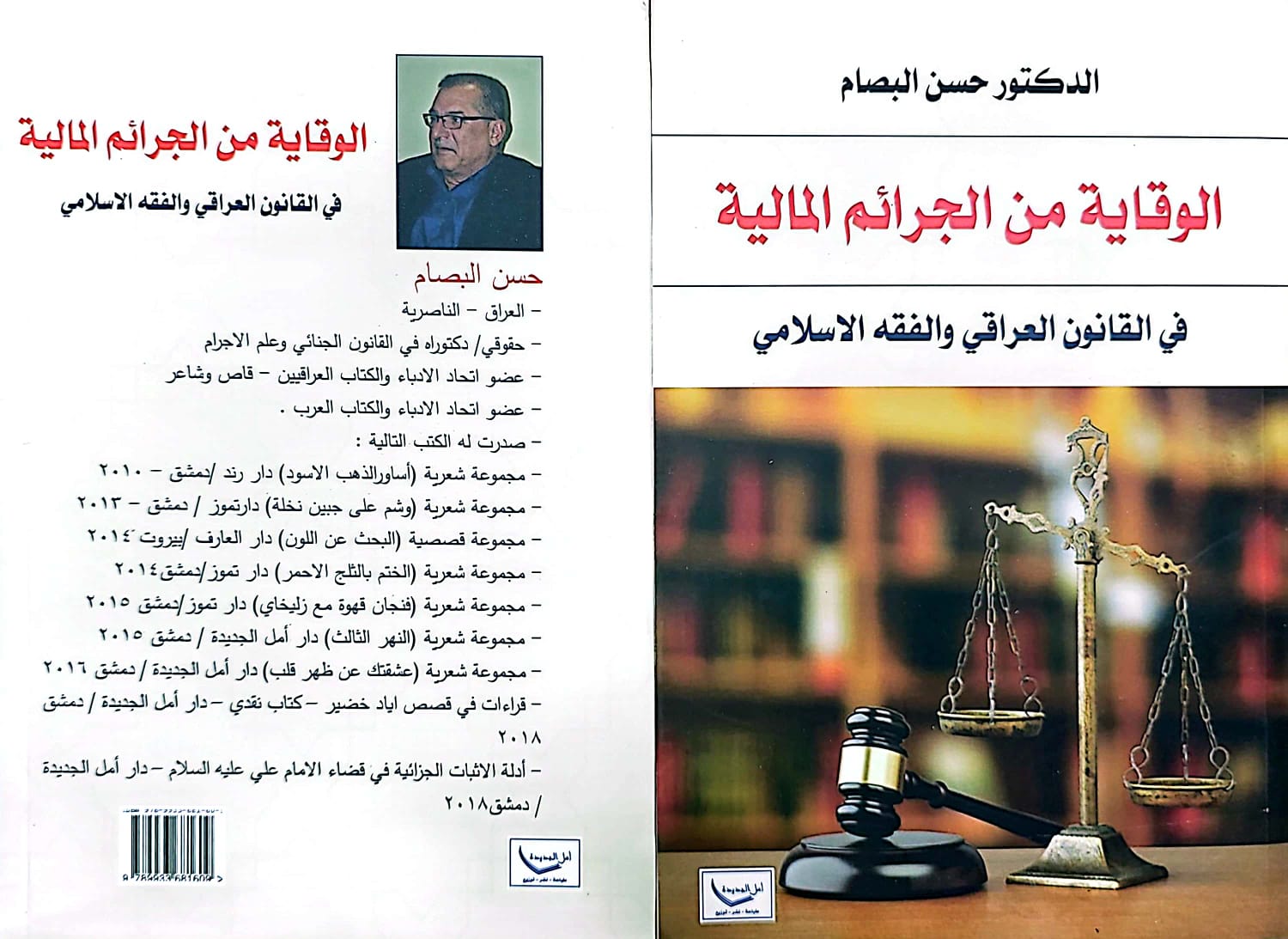

Prevention of financial crimes in Iraqi law and Islamic jurisprudence -

by Hassan Abed Hamod HusanMoney is considered one of the fundamental interests that require protection in man-made laws and Islamic law, because money is indispensable for the continuation of life, and Islamic law has made the status of one who is killed in defense of his money a martyr. The seizure of individuals’ money, whether it is without the owner’s consent, such as theft, or with his consent, using fraud, deceit, fraud, breach of trust, or fraud, is detrimental to the safety and stability of society. Therefore, financial crimes lead to the collapse, disintegration, and backwardness of many societies. Due to the legislator’s inability and lack of seriousness. To prevent it. What contributes to the increase in financial crimes is the spread of poverty, lack of solidarity, and the positive legislator’s move away from establishing spiritual values in the hearts of individuals to build society in a solid ideological manner based on Islamic principles and faith in God.

Preventive measures are the penal measures taken for the purpose of treating the aggressive tendency of the criminal in order to prevent him from repeating the crime. As a result, they aim to protect society from criminal danger and protect its members. Two types of measures are taken: personal preventive measures and in-kind preventive measures, as stipulated in Article (104) of the Iraqi Penal Code states that: “Precautionary measures are either depriving of freedom, restricting it, depriving of rights, or material.

The Iraqi legislator tried to develop methods of preventing financial crime, reforming criminal behavior, and deterring the offender by understanding criminal motives and how to address them. However, financial crimes are rapidly increasing in Iraq due to rapid social and political transformations, and the spread of poverty, destitution, disease, and ignorance, which has contributed to the move away from the Islamic approach. In education, guidance and punishment, the Iraqi legislator was concerned about the laws being constantly changed. This is what made them characterized by their lack of stability.

The Iraqi legislator and Islamic legislation each deal with prevention in methods that are similar in some cases and different in others, and they aim to keep pace with the development of financial crimes. It is important at the present time to make use of these comparisons between Islamic legislation and Iraqi legislation, in order to reach effective prevention that is consistent with the nature of society and ways to protect it from these increasingly widespread crimes and their effects on the interests of individuals and the stability of society.